Our offer to Winstanley and York Road leaseholders and freeholders

When would I have to move?

We have produced a phasing plan in conjunction with our (procured) delivery partner, Taylor Wimpey, which provides more accurate timescales for when each part of the estate will be rebuilt and when individual households will have to move.

Residents will be given a precise moving date at least six months in advance of such a move, in a pre-move rehousing interview.

View our timeline for development

However, there is the option to sell your home to us at an earlier stage if you wish. If this is your preference, find out more about early moves for leaseholders and freeholders.

Property valuation

In the first instance, we will arrange for the Council’s valuer, Carter Jonas, to conduct a valuation of your property. Your property will be valued based on its open Market Value, and on a ‘no scheme world’ basis. This means that the professional valuing your property will ignore the regeneration being planned, and your home’s value will not go up or down as a result.

The Market Value attributed to your home will reflect the internal and external condition of the property at the date of valuation, internal improvements, the location and amenities within the area, and the housing market in the immediate vicinity at the time of valuation.

Even if you ask for a valuation, you do not have to accept it and you do not have to progress with the selling process. If you disagree with our valuation, you can obtain your own valuation using an independent chartered surveyor (contact the Royal Institute of Chartered Surveyors on 0870 333 1600 or via www.rics.org), subject to the agreement of fees by Carter Jonas.

If the valuations differ, Carter Jonas will then discuss the valuation with your appointed surveyor to try to reach agreement as to the value of the property. If agreement cannot be reached, a third party - probably an independent surveyor - will make a final decision on the purchase price.

If you are a resident homeowner and you intend to remain on the estate, you do not need to take any action at this time - we will contact you in due course to discuss your options.

Rehousing and compensation commitments

Regardless of how the regeneration plans may adapt and develop as they are delivered, we maintain the following commitments to resident and non-resident homeowners, as detailed in the October 2014 Leaseholders & Freeholders rehousing information booklet.

Commitments to resident homeowners

Resident Homeowners are those who live in the property as their home.

As a resident homeowner, you will be:

- Offered the market value of your property, plus an additional 10% Home Loss Payment (up to a maximum of £64,000 – an amount set by central government)

- Able to reclaim reasonable valuation, legal and moving costs (i.e. costs associated with moving home, selling your existing property to the Council and purchasing a new home). These include removal expenses, legal and surveyor fees arising from the sale and acquisition of a replacement property, re-direction of mail, alterations to furnishings, disconnection and re-connection of services and appliances, the removal and reinstallation of moveable fixtures and fittings, special adaptations assessed as required in the new property, unavoidable mortgage redemption fees, and stamp duty based on the value of your existing property

- There is no definitive list and claims are governed by the Compulsory Purchase Order (CPO) compensation code

- Loss claims will also be negotiated via the Council’s retained valuers, Carter Jonas, and any items of claim would be discussed directly with them

- Able to purchase a new development property, with an equivalent number of bedrooms, on an ‘equity share’ basis. The development will be phased so those selling their property to the Council will be able to buy and move into their new home immediately, without spending time in interim accommodation.

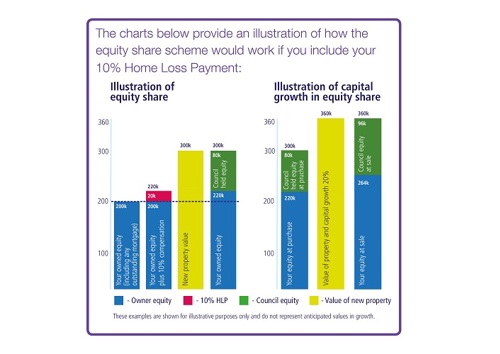

The equity share scheme

The value of your new home is likely to be greater than the value of your present home, so our equity share package has been designed to enable you to afford to purchase the new property.

The funds from the sale of your existing property (market value) will go towards buying the new, higher value property in the scheme. You can opt to keep your 10% Home Loss Payment or use it to increase your equity in the new property. If you are unable to afford to purchase a greater share of the new property or buy it outright, we will hold on to the portion you cannot buy. No rent or interest will be charged on our share. If you have a mortgage, your current level of borrowing will be maintained. You will also have the option to buy up our equity share of the property over time.

If you later decide to sell the new property on the open market, any increase or decrease in value that may have occurred during your ownership would be shared between you and us according to the portion of equity owned by each party.

The equity share offer can be used to buy a property of an equivalent or smaller size (in bedrooms) to your existing property. If you wish to purchase a larger property, we will only offer equity share based on the size of your current property, and you will be required to pay full market value on any additional bedrooms.

If you are unable to purchase a new home suitable for your needs, we will explore alternative housing options with you. If you think that this applies to you, please contact the Regeneration Team.

New development homes

The new homes:

- Will meet the Mayor of London’s quality and size standards

- Can be provided with carpets or other flooring (including underlay or sound proofing), blinds or curtains

- Could have an oven/hob, fridge freezer and washing machine/dryer fitted

- Where possible may have a specific internal layout or special adaptations requested by the residents

Commitments to non-resident homeowners

Non-resident Homeowners are those who live elsewhere and/or rent out their property.

As a non-resident homeowner, you will be:

- Offered the market value of your property, plus an additional 7.5% Basic Loss Payment (up to a maximum of £75,000)

- Able to reclaim reasonable valuation, legal and moving costs (i.e. costs associated with the purchase of a new property in the UK)

The equity share package will not be offered to non-resident homeowners, as it has been designed specifically to help residents who live on the estates to stay in their neighbourhood.

We are under no formal obligation to rehouse any tenant who is subletting the property, or to any other occupant in your property.

We will only conclude the purchase of your property once it is vacant.

It is your responsibility to provide vacant possession in a timely and legitimate manner.

Additional commitments to leaseholders and freeholders

At the Housing and Regeneration Overview and Scrutiny Committee in November 2015, see Paper 15-427, we provided clarification and detail for leaseholders and freeholders on certain areas of the commitments of the regeneration scheme.

Equity share

The shared equity offer has been prepared to assist resident owners to afford to continue to own a property and remain in the area and, in so doing, continue to be part of a stable community. The clarifications below have been provided following questions from some resident owners as to some of the more detailed aspects of the equity share offer.

- An equity share unit lease will have restrictive covenants which prevent leaseholders from subletting their property

- This means that the ‘no rent and no interest’ offer is only available to those leaseholders who continue to reside in the property as their principal and only home

- However, within the restriction there will be exceptions to the no sub-letting policy where, for instance, the owner needs to move away for a certain period due to a change in their circumstances (for example, a work contract, caring for a relative etc.)

- Equity share owners who wish to sublet under exceptional circumstances should contact us for an agreement in writing

- A more detailed policy will be drawn up in advance of marketing the shared equity offer, which will set out a fuller list of exceptional circumstances

- An equity share product will terminate on the sale of the property to the open market, with each party taking from the sale their portion of the equity

- Should the resident leaseholder pass away, the property with the equity share offer may be passed on through inheritance on one occasion

Defining resident and non-resident owners

For the purposes of their treatment in line with the offer outlined above, resident and non-resident owners will be defined as follows:

- Resident owners should have been resident in their home on the date on which we entered into a Joint Venture arrangement with Taylor Wimpey (20 September 2017). Resident owners should continue to be resident in the home from that date forward until the date when an agreement is reached with us to sell the property to us or to move into a new home within the development

- A detailed exceptions policy will be prepared to cover circumstances where residents may temporarily not be occupying their home. This will include:

- Having to be abroad as a result of employment by armed forces;

- A fixed term work contract in a location where it is not reasonable to expect them to reside in the property; or

- An education or training course in a location where it is not reasonable to expect them to reside in the property. This should be their only owned UK residence, and be available for their occupation on termination of an assured short-term tenancy.