Market Position Statement - Challenges for adult social care

Back to the Market Position Statement home page.

Overview

The coronavirus pandemic has highlighted and exacerbated several challenges facing the adult social care market.

One challenge is the lack of long-term funding facing local authorities, despite the growing demand for adult social care services. It is estimated that between 2018 and 2038, total costs for care are projected to rise by 90% for adults aged between 18 and 64 to £18.1 billion, and 106% for those adults aged 65 and over to £37.7 billion.

Additionally, workforce challenges continue at pace, with concerns over recruitment and retention. It is clear, that despite these numerous challenges, local authorities and providers are working together to deliver essential adult social care services to residents and with the increased focus on integration through the health and care act of 2022, it is expected that this collaboration will strengthen.

Financial challenges

Local government and adult social care departments are continuing to face a challenging financial position. In 2021/22, the London Borough of Wandsworth’s net spend was £210,843,200, of which £78,109,800 was spent in adult social care and public health, which is a proportion of 37%. The net spend for adult social care is estimated to increase by £294,000 to £78,659,000 in 2022/23, with overall net expenditure set to decrease by £12,249,200 to £198,594,000. For further information see the budget for 2022/23. In addition to making savings, budgets are being affected by inflation.

Residents across the borough are facing a cost-of-living crisis due to rising inflation caused by the impact of the coronavirus pandemic, Brexit and the increased global energy prices following the war in Ukraine, combined with real term wages falling. Rising inflation is having severe economic consequences for the market as well as increased risk of pressure on the demand for social care as residents are increasingly unable to afford fees in the private care market.

Managing within budget constraints

We have completed our ‘cost of care report’ and developed our Market Sustainability Plan.

We will adopt a robust evidence- based approach to commissioning with a clear understanding of demand and supply enabling us to proactively plan and develop services in a cost effective and sustainable manner, minimising for example costly spot or out of borough placements.

We will continue to pursue a preventative approach to service provision, delaying and reducing the need for care and support and continue to focus on a strengths-based approach which identifies resources within the family and community.

We will look towards transforming and innovating our services to improve outcomes and efficiencies through e.g., increasing our use of digital technology and encouraging providers to adopt more digital solutions.

We will work in partnership with our partners including housing, integrated care systems and neighbouring authorities to identify opportunities to jointly plan and commission provision to maximise benefits, outcomes and resources and achieve efficiencies.

Demographic challenges

The Greater London Authority’s population projections for the Wandsworth population are:

| 2023 | 2028 | Increase | 2033 | Increase | 2038 | Increase | |

|---|---|---|---|---|---|---|---|

| 18 to 64 increase | 241,901 | 241,784 | 0% | 237,637 | -2% | 234,681 | -3% |

| 65+ increase | 32,446 | 35,845 | 14% | 42,347 | 31% | 47,228 | 46% |

In line with the national picture, the number of older people in Wandsworth is projected to increase. Wandsworth faces a sharp growth of 46% in the older population by 2038 which equates to an increase of 14,782 (compared to a decrease of 3% for those aged between 18 and 64, many of whom will live with age-related needs that will make them more vulnerable to long- term limiting illness, issues with mobility and mental health including dementia. The sharpest increase is in the 65-74 plus age group of 52% which represents an increase of 9,155.

With people living longer and increasing numbers of people with chronic or multiple conditions, this is likely to drive future extra demand for health and social care services.

Adult need demographic prevalence headlines

Data source: POPPI and PANSI (2020)

- It is estimated in 2020 that there were 2,198 adults over the age of 65 living with dementia. This is set to increase sharply by 69% in 2040, with an estimated 3,711 adults aged 65 and over living with dementia.

- Wandsworth also faces a steep projected increase in the older (65+) learning disability population of 62% by 2040 from 672 to 1,086 compared to overall projected increase of 5% 18-64 learning disability population).

- In 2020, an estimated 32,100 residents who are 65 and above lived within Wandsworth. This is predicted to increase at a rate of 60% by 2040, to 51,400 residents. This is the highest increase seen within any age group.

- In 2020, an estimated 16,919 residents aged between 18 and 64 in Wandsworth lived with a common mental disorder in 2020. By 2040, this is set to increase to 17,734, a rate of 5%.

- In 2020, an estimated 5,768 adults aged between 18 and 64 lived with a learning disability. For those aged 65 and over, an estimated 672 are also estimated to have had a learning disability

- By 2040, for those aged between 18 and 64, this is set to increase to 6,075, at a rate of 5%

- By 2040, for those aged 65 and above, this is set to increase to 1,086, at a rate of 62%

- In 2020, there was an estimated 9,854 residents aged between 18 and 64 in Wandsworth living with impaired mobility. By 2040, this is set to increase to 10,788, a rate of 9%

Demand pressures

Between April 2021 and March 2022, our adult social care services were supporting 3,747 residents through care packages. This includes those people supported in care homes (23%) as well as those receiving community-based services (77%).

- Demand for specialist residential and nursing beds is increasing, sometimes resulting in placements being made in out-of-borough specialist placements. There is a need for enhanced in-borough residential and nursing care home placements for people with mental health needs and people with complex needs including dementia needs and bariatric care.

- Demand for supported living provision for adults with mental health needs and learning disabilities and/or autism has experienced growth in recent years and is expected to continue. This increase is attributable to the drive to support people to live more independently, reducing the reliance on residential care.

- There is a continued growth in the number of adults with mental health needs accessing adult social care services which may in part be due to the longer-term impact of the pandemic, resulting in a number of residents facing issues of isolation, and other mental health related issues, including anxiety and stress.

- Demand for home care particularly for more complex, specialist packages is expected to increase particularly with pressures on the market relating to hospital discharges.

Refer to the evidence base for details on trends in service use including during the coronavirus pandemic, together with projections.

Social care workforce challenges

One of the biggest challenges to delivering sufficient, high-quality services is the availability and quality of the workforce. We acknowledge the continued workforce challenges facing our providers. Specifically, there are continued concerns regarding recruitment and retention with the care industry, as well as the voluntary and community sector, facing competition from other sectors that offer more attractive staff benefits, pay, terms and conditions i.e. NHS, hospitality sector and supermarkets.

Providers have reported that other factors such as the national living wage, changes to employment law and the uncertainty surrounding Brexit have all made workforce issues even more challenging. The availability of nursing staff is a further issue. As dementia diagnoses increase, it is crucial that there are sufficient care workers and nurses, as well as other allied health professionals, trained to support people living with dementia.

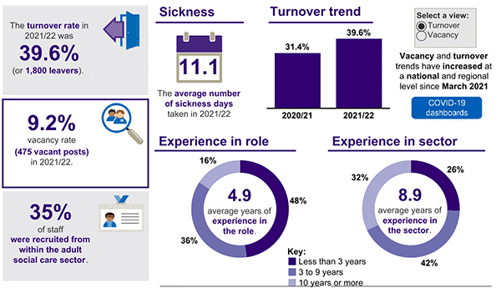

Data source: 2021-22 Skills for Care adult social workforce data (all services within the independent sector, including CQC non-residential, CQC care only home, CQC care home with nursing, CQC other, non-CQC)

- Wandsworth has a high level of staff turnover at 39.6% compared to London at 30%

- Wandsworth has a vacancy rate of 9.2% compared to London at 10.4%

- In Wandsworth the workforce has on the same level of experience in their role at 4.9 years when compared to London

- Also, less staff in Wandsworth are recruited from within the adult social care sector at 35%, compared to London at 64%

View more information on the Skills for Care local area dashboard.

Messages to the market - supporting workforce development

We will support providers in the ongoing challenges surrounding workforce, specifically recruitment and retention of care workers. To achieve this, we will:

- Work on a sub-regional level with south west London boroughs. Together with partners across the integrated care system we are developing a joint social care workforce development strategy and plan for the sector, supporting a coordinated regional approach

- Work with Southwest London integrated care services (ICS) on the delivery of specialist training e.g. dementia training to support residents with complex needs

- Commit to the London living wage, ensuring for new contracts, contracted service providers pay their staff at least the London living wage.